Hoa Sen Group “returns to the domestic market” with the Hoa Sen Home chain

- Hoa Sen Group launches premium, ultra – durable Hoa Sen Mag Shield roofing

- Hoa Sen Home launches first standard dealers, elevating the building materials shopping experience

- Hoa Sen Group maintains winning streak, securing a double victory for the third consecutive year at Vietnam Creative Advertising Awards

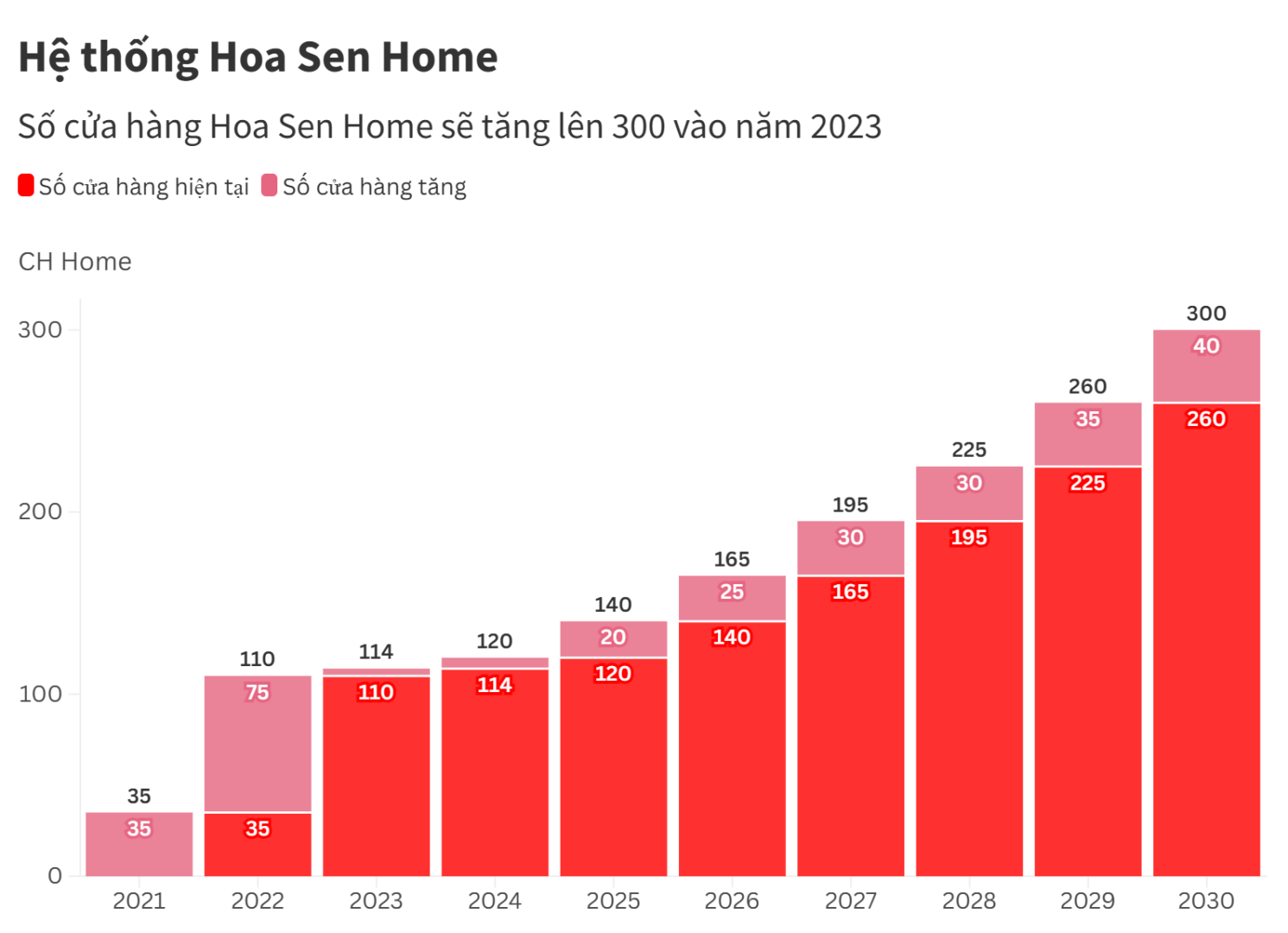

Hoa Sen Group plans to invest VND 6 trillion to develop 300 stores by 2030.

The 2025 Annual General Meeting of Shareholders (AGM) of Hoa Sen Group (HOSE: HSG), held on March 18, approved key proposals, including the strategic restructuring of the Group’s operating model and the establishment of Hoa Sen Home Joint Stock Company.

During the AGM, Group representatives outlined the compelling reasons for restructuring. The Board of Directors anticipates that the broader economic environment, particularly the steel and roofing sector, will remain highly volatile and present significant challenges. Many countries and territories are implementing stringent protectionist policies for domestic production. Geopolitical instability persists in several regions, while political transitions in the United States raise substantial risks of renewed trade wars. As a result, steel and roofing exports face mounting difficulties, making it challenging to maintain stable market shares.

According to Mr. Le Phuoc Vu, Chairman of the Board of Directors, export activities will pose serious challenges for most enterprises in the medium term amid these trends. “I’ll be direct: the steel industry will be fortunate just to maintain a flat growth trajectory; the overall trend is likely to decline,” he stated. “Domestic factory capacity currently exceeds national demand by threefold, while exports grow increasingly difficult—staying flat would already be a remarkable achievement.”

“The wisest path is to return to the domestic market and focus on developing the Hoa Sen Home Chain,” Mr. Vu emphasized before the shareholders.

He noted that the current moment offers a favorable window to accelerate store expansion and increase retail space, as traditional trade outlets may face obsolescence in the next two to three years. In his view, the Hoa Sen Home Building Materials & Furniture Supermarket Chain will serve as the modern successor to conventional stores.

“I affirm that building a nationwide distribution system for building materials and furniture like Hoa Sen Home is an exceptionally demanding endeavor,” Mr. Vu added. “Its complexity explains why no comparable system has yet emerged in Vietnam. Previously, HomePro attempted to establish a chain of building material supermarkets here, but persistent losses led to the closure of several locations.”

The Group’s top leader expressed strong confidence in Hoa Sen’s readiness, citing its robust financial capabilities, established brand, consumer trust, nationwide management team, and solid supplier relationships as key foundations for successfully scaling the Hoa Sen Home supermarket chain.

Hoa Sen Home will build on the Group’s unique nationwide network, corporate reputation, and brand assurance for product quality. This represents immense potential. The parent company’s revenue hovers around USD 2 billion.

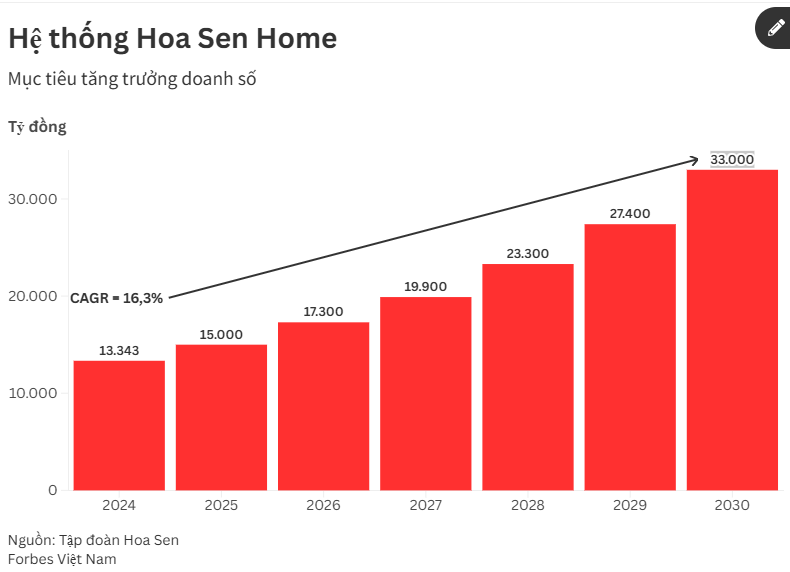

“I believe Hoa Sen Home will soon achieve revenues of USD 1–2 billion—and potentially far higher—with effective execution and management,” Mr. Lê Phước Vu confidently declared.

Consequently, Hoa Sen Group has designated the Hoa Sen Home chain as the primary growth engine for the next 5–10 years.

Mr. Tran Thanh Nam, Deputy General Director overseeing the Hoa Sen Home retail segment, reported that the 410 Hoa Sen Home stores generated VND 13,343 billion, accounting for nearly 15% of the Group’s total revenue. The chain targets VND 15,000 billion in sales for 2025.

In the initial phase, Hoa Sen Group will hold over 99% of Hoa Sen Home Joint Stock Company. Over the following five years, the subsidiary will progressively assume full operations of the 410-store Hoa Sen Home system from the Group, achieving stable performance and profitability.

Looking ahead, should conditions prove favorable at an appropriate juncture, the Board will refine plans and timelines for a public share offering and stock listing of Hoa Sen Home Joint Stock Company.

The company aims for an average annual compound growth rate of 16.3%. In 2025, Hoa Sen Group plans to allocate VND 1,060 billion to advance the Hoa Sen Home system, including VND 400 billion for store expansion, VND 500 billion for warehouse infrastructure, VND 60 billion for technology, and VND 100 billion for marketing initiatives.

According to PwC—the consultant advising Hoa Sen—successful building materials supermarket chains in countries such as Thailand, Indonesia, and the United States demonstrate the model’s viability and present a clear opportunity for a similar format in Vietnam.

While Vietnam features the prominent Hoa Sen Home chain (average store area of 1,200 m²), Thailand hosts HomePro (average 9,000 m²) and Thaiwatsadu (average 14,000 m²), and Indonesia has Depo Bangunan (average 6,000 m²).

At the close of fiscal year 2023–2024, Hoa Sen Group recorded consolidated revenue exceeding VND 39 trillion, up 24% year-on-year, with consolidated after-tax profit surpassing VND 510 billion—a sixteenfold increase from the prior year.

Vietnam Forbes